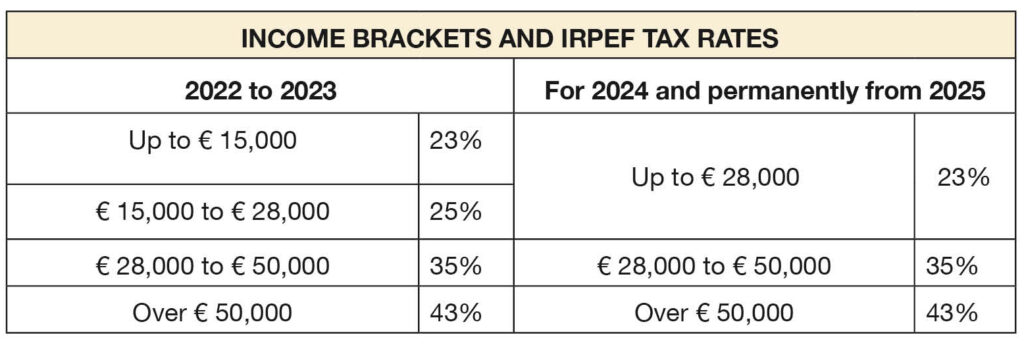

First, the 2025 Budget Law permanently reduces the number of IRPEF tax brackets from four to three, a change initially introduced for 2024 as an exception to the Consolidated Income Tax Act (TUIR) by Legislative Decree no. 216/2023.

The updated progressive tax brackets are now as follows:

- 23% for income up to €28,000

- 35% for income between €28,000 and €50,000

- 43% for income over €50,000.

In addition, the tax deduction for employment income has been increased from €1,880 to €1,955 for incomes up to €15,000. This adjustment also increases the “no-tax area” to €8,500, extending its application also to employees, as already provided for pensioners. The comparative table below shows the IRPEF brackets from previous years alongside the permanent changes effective from 1 January 2025.