The Budget Law has introduced a new measure to reduce the tax wedge, which, unlike the 2024 provision, does not involve lowering the employee’s contribution (previously 6% or 7%). Instead, this reduction will solely have fiscal effects.

Two new measures have been introduced: the first is for employees (thus excluding assimilated income) with total income not exceeding €20,000. A sum, not included in taxable income, will be provided based on a percentage of employment income.

This variable amount is calculated as a percentage of taxable income as follows:

- 7.1% for income up to €8,500

- 5.3% for income between €8,500 and €15,000

- 4.8% for income over €15,000.

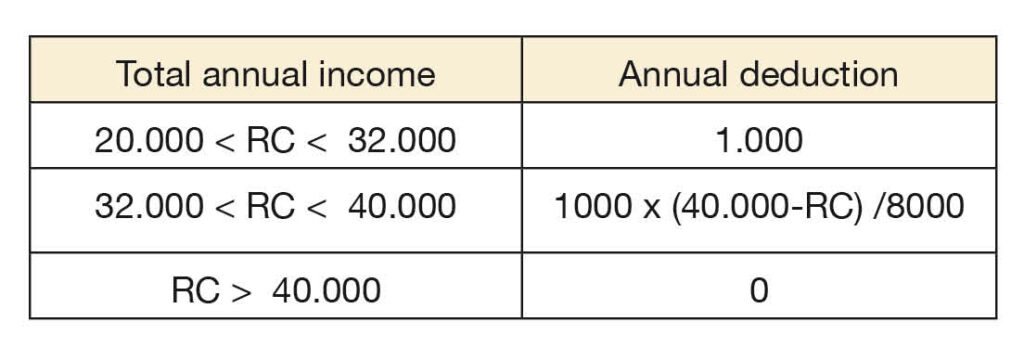

The second measure introduces an additional tax deduction for employees with annual total income (TI) above €20,000 but less than €40,000. This deduction is €1,000 for incomes up to €32,000. Above this amount, the deduction decreases progressively to zero for income of €40,000.

In both cases, the amounts are proportional to the period of employment and are automatically recognised by the withholding agent in each pay period.