Inland Revenue Agency (Agenzia delle Entrate) Circular 5/E of 7 March 2024 provides some clarifications on fringe benefits and confirms the current provisions on the taxation of performance bonuses.

1.1 FRINGE BENEFIT

Various new features that were already set out in the Budget Law are explained, namely:

- Non inclusion of fringe benefits in taxable income for the purposes of personal income tax (IRPEF), up to an annual limit of €1,000 for everyone (and €2,000 for employees with dependent children);

- In addition to the usual forms of fringe benefits, it is possible to reimburse staff for household utilities (water, electricity, gas—already available in 2023), for rent-related expenses (new in 2024) and for interest expenses on a first home mortgage (new in 2024);

- If the amount is exceeded, the entire amount is included in taxable income and not just the portion exceeding the annual limit;

- Such measures are individual and so can be paid to specific individuals at a company.

More specifically, and only for the 2024 tax year, the following provisions are in place:

A) (as of 2023) The fringe benefits provided to employees can also include amounts paid or reimbursed to employees by their employers for the payment of household utilities at properties “FOR RESIDENTIAL USE”

- Integrated water service

- Electricity

- Natural gas

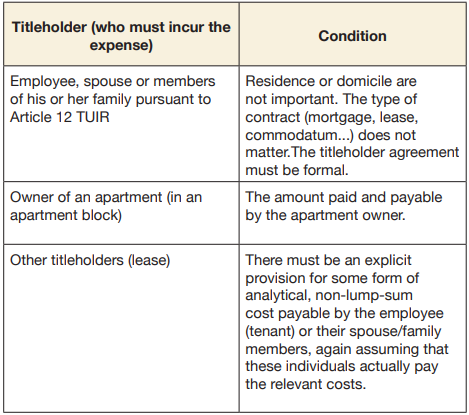

The following are the required characteristics for an expense to be reimbursable:

As such, the employer must obtain and retain the relevant documentation justifying the amount in question and its inclusion in the limit under Article 51(3) of TUIR.

Alternatively, the employer can accept a signed statement in which the applicant employee certifies that he or she has proof of payment of household utilities.

B) Fringe benefits provided to employees also include amounts paid or reimbursed by employers for the payment of:

- Costs for renting a first home (new 2024)

- Interest expense on a loan for a first home (new 2024)

Any such property must be:

- For residential use

- Officially (i.e. with appropriate documentation) owned by or in the name of the EMPLOYEE or the EMPLOYEE’S SPOUSE or FAMILY MEMBERS

- The USUAL PLACE OF RESIDENCE of the employee or his/her family

The expenses must be actually incurred by the EMPLOYEE or his/her SPOUSE or FAMILY MEMBERS provided that for the employee the property is his/her PRIMARY PLACE OF RESIDENCE.

Employers also have to acquire a signed statement that the invoices in question have not already been the subject of a claim for reimbursement, in whole or in part, from the same employer or another employer. This statement must be kept by the employee in the event of an audit by the tax authorities.

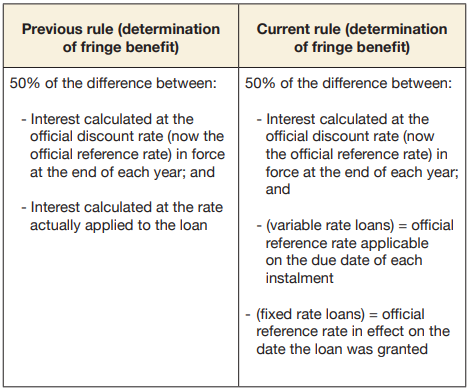

1.2 DETERMINATION OF PAYMENT IN KIND FROM LOANS GRANTED TO EMPLOYEES

There has been a change in the method of determining a fringe benefit for employer-provided loans to

- An employee

- A spouse

- Another family member

1.3 TAX RELIEF FOR COLLECTIVE PERFORMANCE BONUS PLANS

In 2024, the rules remain in place allowing the use of a subsidised rate (tax relief) of 5% in the case of bonus payments for a performance bonus plan agreed with labour unions.

As a reminder, this a substitute tax for the personal income tax (IRPEF) and any related surcharges on taxes. It applies to variable performance bonuses granted on the basis of improvements in productivity, profitability, quality, efficiency and innovation. These improvements must be measurable and verifiable in accordance with the criteria set out in the interministerial decree issued by the Minister of Labour and Social Policy jointly with the Minister of the Economy and Finance on 25 March 2016. It also applies to payments received in the form of profit-sharing from the company. The substitute tax is applied, up to a gross amount of €3,000, to a cash bonus paid to private-sector employees on the basis of company or local-area contracts for work income, in the year preceding the year of receipt, not exceeding €80,000, including the increase.