The 2025 Budget Law has introduced key changes to the taxation of fringe benefits on company cars provided for mixed private and business use, revising the percentages applicable to vehicles both granted and registered from 1 January 2025.

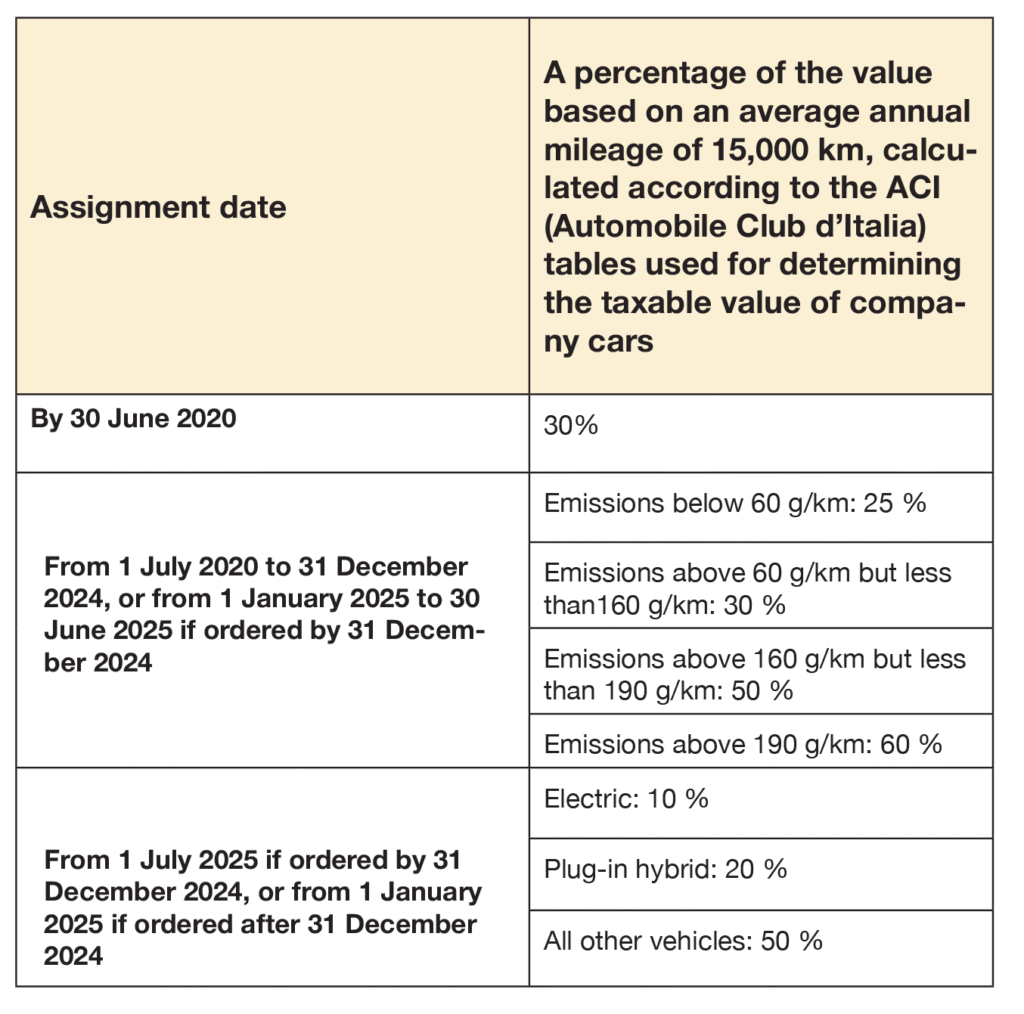

The taxable value of the fringe benefit is calculated as follows:

- 10% for electric vehicles

- 20% for plug-in hybrids

- 50% for all other vehicle types

However, article 6, subsection 2-bis, and article 1, subsection 48-bis contain some key clarifications:

- cars ordered by 31 December 2024 and assigned to employees between 1 January and 30 June 2025 remain subject to the rules in force up to 31 December 2024, where the fringe-benefit percentage depends on CO₂ emissions .

Below is a summary of the regulatory changes over the years: