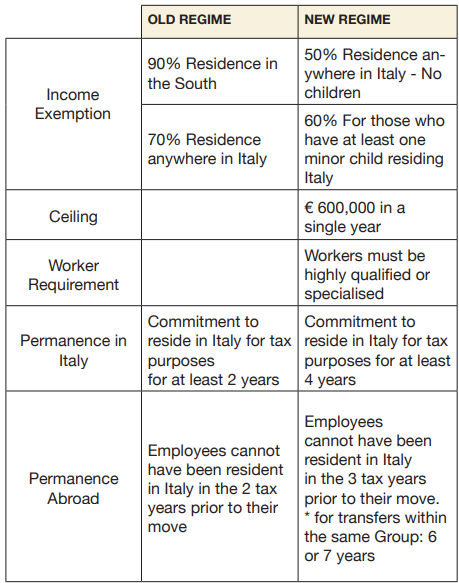

Legislative Decree 209/2023, which implements the tax reform of the particular regime related to people who have moved their residence in Italy from abroad,, abolished the “returning worker” tax regime in force until 2023 and introduced a new regime, applicable from 2024, for persons transferring their residence to Italy. This new system allows a tax exemption for a maximum of 5 fiscal years, equal to 50% of the total income, within an annual limit of €600,000.00. The exemption applies to income from employment, from equivalent work and self-employed work carried out in Italy

Thus, the distinction between those who acquired residence in southern Italy, which offered a tax reduction of 90 per cent of income, and other areas of Italy, which offered a tax reduction of 70 per cent, has been eliminated. Moreover, while the reduction has been reduced to 50 per cent for all beneficiaries, it has been increased to 60 per cent only for those who move to Italy with a minor child who becomes resident.

In addition to this reduction in the level of the relief, new requirements will be introduced to restrict the pool of beneficiaries. In fact, for the application of the new regime, the following must be met:

a) Employees must be highly qualified or specialised.

b) Employees must agree to remain in Italy for at least 4 years.

c) Employees cannot have been resident in Italy in the 3 tax years prior to their move.

Specifically in relation to (c), if the work is carried out in Italy for the same company or for a company belonging to the same group with which he/ she was employed abroad before the transfer, the minimum period of residence abroad is increased from the standard 3 tax periods. Indeed, it is expected to be 6 tax periods if the beneficiary was not employed in Italy by the company before moving abroad, or 7 tax periods if the beneficiary was employed in Italy by the same company before moving abroad.

The new rules will apply to those who move their residence to Italy from 2024. As such, the previous rules will remain in force for those who moved their residence by 31 December 2023, including those who, having transferred their residence in the second half of 2023, will be considered tax residents in Italy in 2024 for the first tax year.

This table provides a summary:

In addition, we are still awaiting a circular from the Italian tax authorities clarifying various operational aspects of the above.