With its publication in the Official Journal, Legislative Decree 209/2023 has taken effect, making significant changes to the linkage criteria for defining the tax residence of individuals.

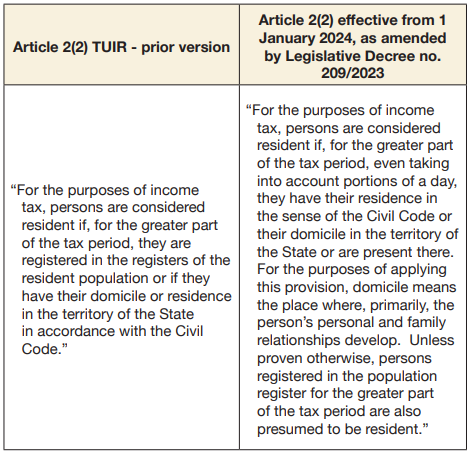

The two texts of Article 2(2) of Presidential Decree no. 917 of 22 December 1986 are compared below:

Article 2(2) of Presidential Decree no. 917 of 22 December 1986 provides that, for the purposes of income tax, persons who, for the greater part of the taxable period, alternatively:

- have their domicile in the territory of the State, understood as the place where, primarily, the person’s personal and family relations develop;

- have their residence, pursuant to Section 43 of the Civil Code, in Italy;

- are physically present within the country’s borders.

Although there has been no change to the reference, for residence, to the civil-law concept found in Section 43 of the Civil Code, the civil-law concept of domicile has been replaced with a criterion based on the substantive situation. This change will result in the exclusive importance of “the place where, primarily, the person’s personal and family relationships develop”, regardless of their economic and work interests.

Persons who are registered in the population registers for the greater part of the tax period are also considered to be resident, unless they can prove otherwise. This linkage criterion is a relative legal presumption, meaning a person who is actually resident abroad can submit proof to this effect.

The provision in question states that the conditions of residence must exist for the greater part of the tax period – i.e. for more than 183 days – whereby, for the purpose of calculating days, non-consecutive periods and fractions of a day are also taken into account.

One particular area to watch will be the assessment of the concrete impact of these significant legislative changes, both in terms of the tax benefits available to those who transfer their residence to Italy, such as the scheme for returning workers, and in terms of determining what treatment is applicable to people who transfer their tax residence abroad.

Enrolment in the registry of italians abroad – important changes introduced by the budget law 2024.

With regard to changes that result in a transfer of residence abroad or from abroad, the Budget Law of 30 December 2023 has adopted harsher measures for people who fail to declare such a move.

The following citizens are required to register with AIRE (i.e. the Register of Italians Resident Abroad):

- Someone who moves permanently abroad for a period of at least 12 months;

- Someone who resides permanently abroad, for example, if they were born abroad but have Italian citizenship;

- Someone who has acquired Italian citizenship but lives permanently abroad.

Enrolment was already compulsory because of Law 1228/1954, but from 2024 the Budget Law provides for an increase in the fine payable from €200.00 to €1,000.00 for each year of non-enrolment, up to 5 years, and for each person in the same household, including minors.

The penalty is reduced to one tenth of the minimum amount – i.e. to €20 – if this is communicated within ninety days, provided that the infringement has not yet been established and, in any event, that no administrative investigation has been commenced of which the offender was formally aware.

Any investigation and imposition of fines must be notified, under penalty of expiration, by 31 December of the fifth year following the year in which the failure or omission to comply with the registration or residence requirement occurred.