On 16/02/2024, an agreement was signed to renew the National Collective Agreement for Professional Practices. The main changes in the regulations and economic terms are indicated below.

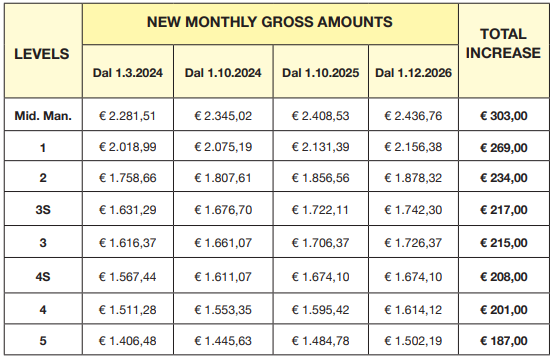

2.1 ECONOMIC AND WELFARE SECTION

This increase is to be considered as absorbable, up to capacity, in the presence of advances on future contractual increases.

2.1.2 ONE-OFF PAYMENT

For workers in force on 16 February 2024, a one-off payment of EUR 400 gross for each level was provided for, broken down as follows:

- 200 Euro on 1 May 2024;

- 200 Euro on 1 May 2025.

This one-off payment will be pro-rated on the basis of the months worked during the period from 1 April 2018 to 29 February 2024 (counting months of 15 days or more as a full month) and, for part-time employees, on the basis of the hours specified in the individual contract.

Regarding the determination of length of service (seniority) for the purposes of the one-off payment, the periods of absence due to maternity/paternity leave, parental leave, breastfeeding, child illness, suspension or reduction of working hours as part of wage guarantee schemes are to be counted for the purpose of the pro-rata calculation. However, periods of unpaid absence are to be excluded.

Finally, the one-off payment:

- Can be paid using welfare instruments.

- Is not included in severance fund (TFR) calculations.

2.1.3 SUPPLEMENTARY HEALTHCARE

From 1 March 2024, the total contribution to the bilateral agencies (Cadiprof and Ebipro) increases to €29 for 12 monthly payments, also for part-time staff, and is divided as follows:

- €20 (increase of €5) to Cadiprof.

- €9 (increase of €2) to Ebipro, of which €7 to be paid by the employer and €2 to be paid by the employee.

An employer who fails to pay the above contributions will be required to pay the employee a Distinct Component of Pay (EDR) of €43 for 14 months and will still have to guarantee benefits and services provided by the bilateral system.

One day of paid leave has also be added. This must be taken in the year of accrual and it is for preventive health activities under the Cadiprof plan. If the employer is not a member of the bilateral system, it must reimburse the employee for the cost of such preventative actions.

Should this leave not be used, it cannot be converted into an allowance.

2.2. RULES: MANAGEMENT OF ABSENCES AND LEAVE

2.2.1 MATERNITY AND LEAVE

For compulsory maternity leave on or after 1 January 2025, the allowance paid by the Social Security Institute (INPS) must be supplemented by the employer so as to reach 90% of the gross monthly salary to which the woman would have been entitled if she had been working.

2.2.2 CONGRATULATION LEAVE

Based on the current regulations, congratulation leave can also be taken for civil unions, with effect from the third day before the celebration.

2.2.4 WOMEN WHO ARE VICTIMS OF VIOLENCE

Female workers on protective pathways related to gender-based violence are entitled to a maximum of a 90-day period of leave. Except in cases of objective impossibility, the employee must notify the employer at least 7 days in advance, stating the beginning and end of the period of leave and submitting the certificate of inclusion in the protective pathway.

During the leave, the woman is entitled to an allowance equal to her last salary, paid in advance by the employer (and then adjusted on the INPS contribution statement).

Such leave may be taken on an hourly or daily basis over a period of 3 years.

At the employee’s request, the leave can be extended for a further 90 days, with the employer paying an allowance equal to her normal salary

2.3. RULES: EMPLOYMENT RELATIONSHIP AND CONTRACT TYPES

2.3.1 PROBATION PERIOD

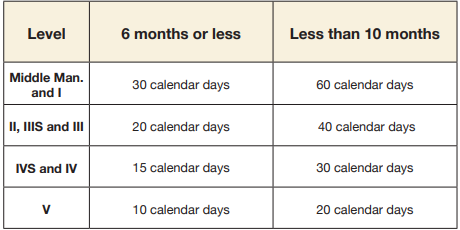

The renewal introduced a requirement to proportionally re-calculate the probation period in the case of fixed-term employment. In particular, the length of the probation period should vary depending on whether the duration of the relationship is 6 months or less, or more than 6 months but less than 10 months.

Finally, in addition to reaffirming the ban on repeating the probation period in the case of being hired more than once by the same employer and for the same job, it should also be noted the probation period is considered suspended in the case of illness, injury, compulsory maternity/paternity leave and in all cases of leave or absence regulated by the Collective Labour Agreement during which no work is scheduled.

Conversely, holidays, leave and previous bank holidays do not suspend the probation period.

2.3.2 FIXED-TERM WORK

The contractual reasons for signing or extending fixed-term contracts beyond 12 months (and up to 24 months) have been defined:

- Temporary increase in business as a result of obtaining temporary professional assignments of more than 12 months or extended beyond 12 months.

- Commencement of new business, a business combination or merger for the first 36 months after the commencement of the new business, business combination or merger

Additional cases of non-application of the quantitative limits on the use of fixed-term contracts have been introduced:

- Hiring of suspended workers based on the CIGS wage guarantee scheme or similar.

- Hiring workers who receive the NASPI allowance.

- Hiring workers who return to employment after a period of unemployment of at least 12 consecutive months or with one or more spells of up to a total of 8 months in the 24 months preceding the fixed-term job.

Finally, the order of priority for transitions from temporary to permanent employment status does not apply to companies with up to 5 employees.

2.3.3 APPRENTICESHIP FOR AN ARTICLESHIP

The period of an articleship (or internship) before being admitted to a professional order can also be done on the basis of a high-level research and training apprenticeship contract for young people aged between 18 and 29 and having a duration equal to the period of the articleship (at least 6 months).

The apprentice’s pay is determined on a percentage basis in accordance with Annex B of the Collective Labour Agreement and covers both the periods of employment with the employer and the period of training. However, the minimum duration of theoretical and practical training, both internal and external, must not be less than 300 hours in total.

2.3.4 INTERMITTENT WORK

Such a contract can also be used to implement digitalisation processes. However, being “called” to work must be done at least 24 hours prior to the start of the service; on the other hand, revoking such work must take place at least 2 hours before the activity. If such notice is not given, the employee is entitled to the contractually agreed remuneration for at least one working day

2.3.5 REMOTE WORK

This form of work has been regulated, reiterating the need for an individual written agreement, which must specify the annual, monthly or weekly schedule, which can be changed with at least 24 hours’ notice, as well as the periods in which one is not connected. The priorities for which employees can use these forms of work have also been set in accordance with the current regulations.