After three years without a contractual renewal, on November 11th 2025 the employers’ association Asstel and the trade unions SLC CGIL, FISTel CISL and UILCOM UIL signed a draft agreement for the renewal of the National Collective Labour Agreement for the telecommunications industry. The agreement covers the 2023–2025 period and anticipates the new three-year cycle for 2026–2028.

Below is an overview of the key changes in terms of pay and employment conditions.

New Classification System and Enhanced Protections for the CRM–BPO Segment

For the first time, the renewed Collective Agreement introduces a specific distinction within the sector’s value chain for the CRM–BPO segment (call centres, customer technical support and outsourced services), which is the area most exposed to technological change and transition processes. The aim is to provide greater flexibility in order to ensure economic and employment sustainability and to counteract contractual dumping practices.

One of the key elements of the renewal is the introduction of a new professional classification system, structured around professional areas that group together roles with similar skills, responsibilities and types of activity, replacing the traditional system of levels. The aim is to enhance skills, promote career transparency and facilitate professional development. The model is based on a dual structure: a general framework applicable to the entire sector and a specific framework for CRM–BPO activities.

Pay Increases

With effect from January 2026, base pay will increase in several instalments.

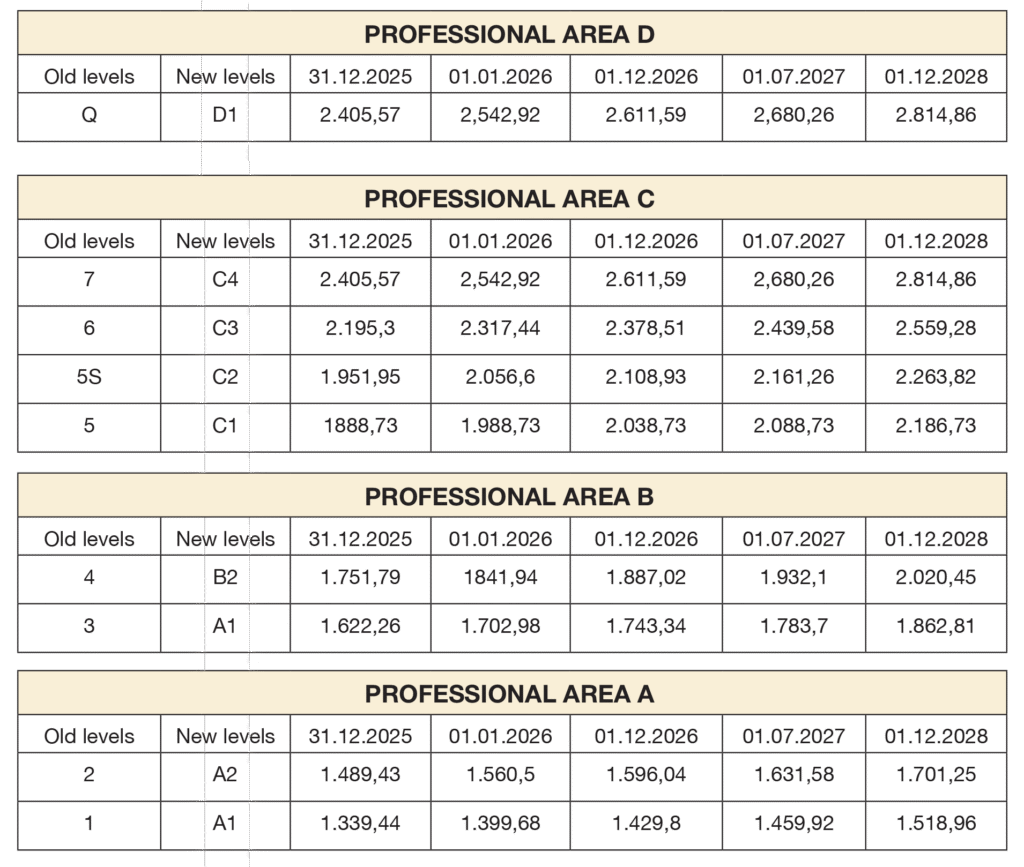

TELECOMMUNICATIONS INDUSTRY

For companies operating in the telecommunications industry, the increases will be applied in four instalments:

- January 2026

- December 2026

- July 2027

- December 2028

The tables set out the new base pay levels, based on the new professional areas.

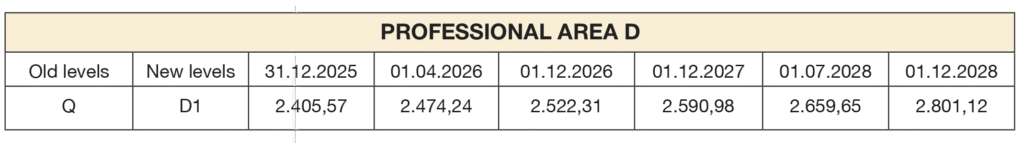

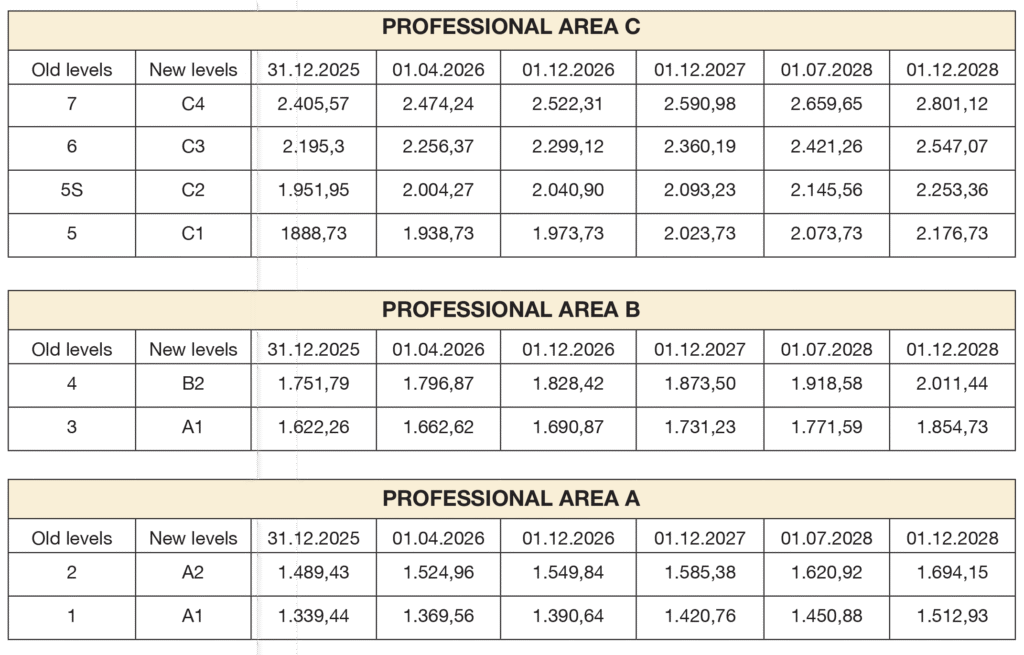

CRM/BPO SECTOR

For companies operating in the CRM/BPO segment, the increases will be paid in five instalments:

- April 2026

- December 2026

- December 2027

- July 2028

- December 2028

The tables below set out the new base pay levels, based on the new professional areas.

Fixed-Term Employment, Agency Work and 4 October Public Holiday

- Fixed-Term Employment: the reasons for fixed-term employment contracts exceeding 12 months (including extension and renewals) have been reintroduced in line with current legislation. In particular, contracts may be used:

- To carry out activities, works and/or services connected with the introduction of technological innovations, and/or the market launch and/or development of new products and/or services, and/or changes to the organisational structure or production processes.

- To carry out installation or assembly work subject to specific climatic or environmental conditions which do not allow the work to be postponed to another period of the year.

- To carry out activities which, due to the volume and/or specific nature of the product/service and/or the required processing, cannot be met with normal production capacity, or which require skills and specialist expertise different from those normally used.

- Probationary Period: aligned with recent legislative changes.

- Agency Work: information obligations have been strengthened, with site-specific reporting requirements introduced for multi-site companies.

- New Public Holiday: the agreement formally recognises October 4th (St Francis) as a public holiday.

Welfare and Improved Protections

The agreement also introduces a number of measures aimed at strengthening pension provision, supplementary healthcare and income-support mechanisms. The key developments include:

- Telemaco Supplementary Pension Fund: an increase in contributions of 0.2% with effect from January 1st 2026, corresponding to €4.38. The total employer contribution will thus rise to 1.6%.

- Sector Supplementary Healthcare: a joint committee will submit, by the end of April 2026, a proposal to establish a sector-wide supplementary healthcare fund from July 1st 2026 for employees who do not have other forms of supplementary coverage. The contribution, fully payable by the employer, will amount to at least €10 per month.